As a startup advisor, I look at a lot of growth models from revenue leaders and founders. Almost every single one makes the same critical mistake - they assume linear BDR ramp and productivity without accounting for the devastating impact of early turnover, bad data, and poor enablement.

The math is brutal. When you zoom out and look at a spreadsheet of all your BDR seats over an 18-month period, up to 50% of your theoretical capacity is lost to extended ramp time, low productivity, and turnover. Your growth model doesn't consider this. Instead, it shows a BDR getting hired, ramping linearly, and magically producing pipeline forever.

Reality is messier. Most BDRs take 4 months to get productive, start delivering results for 7 months, then leave by month 11 because they "want to be an AE" or take another BDR role elsewhere. You've invested heavily in getting them productive just to watch them walk out the door right as they hit their stride.

I've spent the last 10 years obsessing over this problem, and what I've discovered is that building a high-performance BDR team isn't about hiring better people or paying more (though those help). It's about understanding and optimizing a complex system of data, process, coaching, and retention.

I’m going to share my talk from GTM2024 and show you how we've built an outbound motion that:

Generates an average of $72,000 in ARR per BDR per month consistently

Maintains a BDR CAC ratio of 0.13 (we spend $0.13 to generate $1 in ARR)

Has promoted seven BDRs to AE roles in 24 months

Regularly sees new XDRs hitting quota in their second month

10 secrets to high efficiency outbound

Building a highly efficient and predictable outbound motion comes down to a few broad capabilities: data, business process design, and talent development.

Start with the data

Keep the data clean

Enable personalization at scale

Build efficient process

Script as tightly as you can

Coach relentlessly

Performance manage consistently

Dissect your funnel granularly

Attack your show rates

Retain your best people

The Foundation: Why Most BDR Teams Are Built on Sand

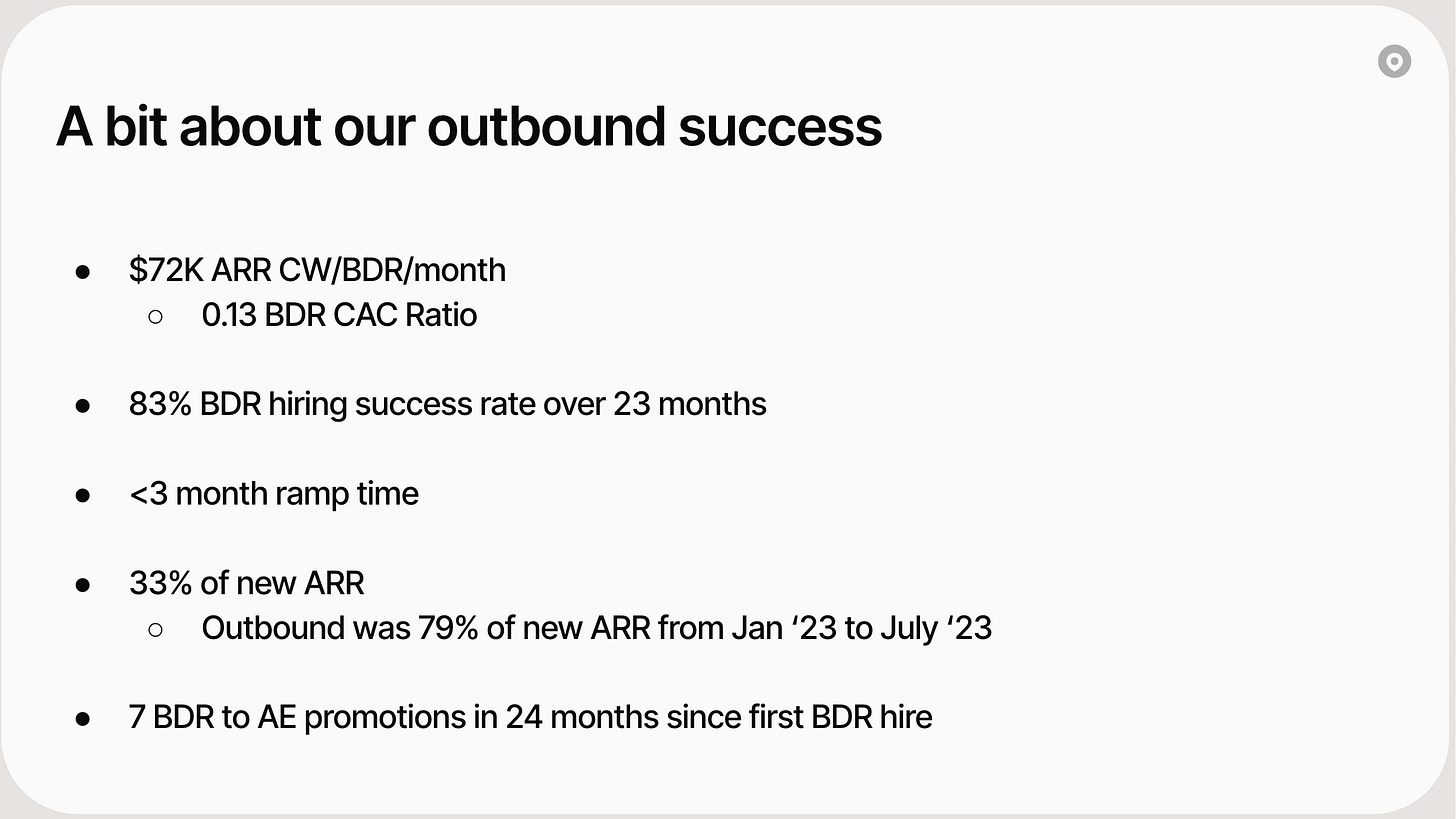

The first problem is that most companies don't spend enough time on what seems like the most boring part of building a sales engine: the data.

If you audit your BDR team's time allocation, you'll likely discover something shocking - they spend between 30-50% of their time on manual research, administrative tasks, and outreach to bad leads. Let that sink in. Half of your BDR's productive hours are being wasted on non-revenue-generating activities.

This isn't just inefficient; it makes your entire motion economically unviable. You simply cannot scale an outbound team with good unit economics if your reps spend half their time doing manual research.

Secret 1: Start with the data

Let me share something that might seem counterintuitive: The companies that will win in the AI era aren't the ones with the fanciest AI tools; they're the ones that do the boring stuff exceptionally well.

At Owner.com, we've made the unsexy work of data quality our obsession. When we started rebuilding our outbound motion, our contact accuracy was around 50%. Out of every 100 dials, only 3% reached a decision-maker. Today, we're at a 13% decision-maker contact rate, and our meeting book rate has gone from 4% to 16%.

That single change took us from outbound BDRs booking a few good meetings per week to consistently booking one to two high-quality meetings per day. This is where our 72K ARR per BDR per month comes from. Not from fancy tools or "growth hacks" - from solving the fundamental data problem.

Three Critical Components of Data Excellence

1. Centralized Data Operations

The ability to find, identify, score, and route leads must be owned by your Data, Business Operations, or Revenue Operations teams. This isn't something you can outsource to tools or leave to individual BDRs. Your Operations functions need to own this as a core competency. I would argue this is one of the most important things these teams can do for you. So, you should prioritize it above almost all else on your data/operations roadmap.

2. Identify & Assign the Highest Fit Accounts

One of the highest-leverage tasks that your data operations team can perform is building a scoring model that consistently delivers the very best leads to your BDRs. You’re looking for accounts that are the most likely to close and are the most valuable in both the short term (high ACV) and long term (high retention). Our data experts built machine learning models to do this, but you can start with a discrete model based on just a handful of factors that you know are highly correlated to account quality (employee count, tech stack, job postings, etc.). You can also hire someone like Jordan Crawford to do it for you with AI in a few weeks.

3. Elite Contact Accuracy

For us, selling to SMB restaurants meant that mobile phone numbers were everything. For your market, it might be direct dials or LinkedIn profiles. Whatever it is, you need to be maniacal about accuracy and completeness. Again, we have an elite data operations team, so they built an elaborate system of web scrapers and enrichment tools, but there are good vendors out there like Datalane (who we use as a critical part of our stack now) that can do it for you in the SMB market.

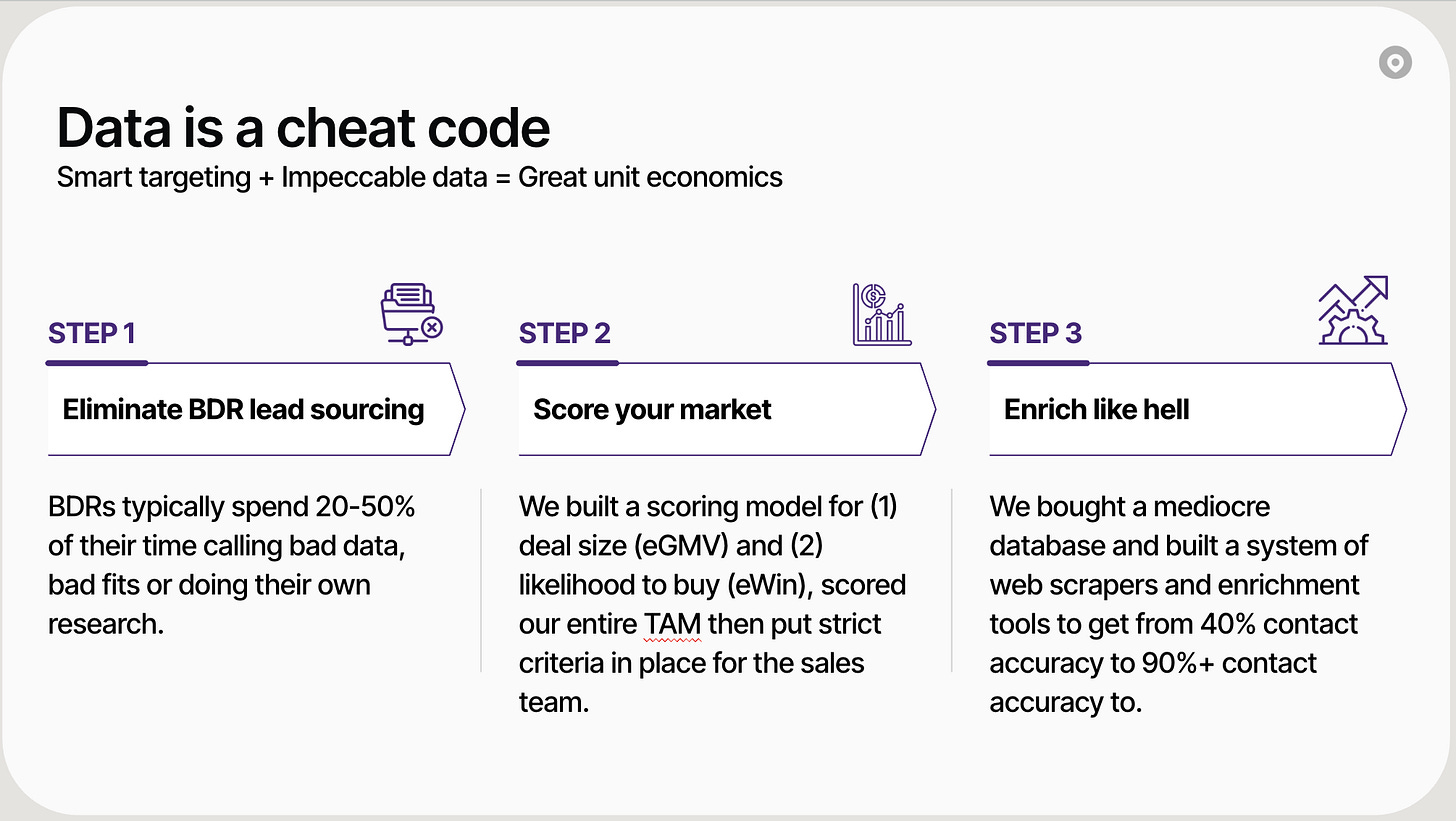

Secret 2: Keep the Data Clean

Your BDRs need a clear, simple way to provide feedback on data quality. Your data is either getting better or worse every day, and that depends on the system you provide to your XDRs to disposition their activity. That daily improvement or degradation compounds across hundreds of activities every single day, and you can quickly find yourself with a rat's nest of a CRM before you know it.

We built a simple call sentiment and disposition infrastructure matrix so that reps can quickly give us important feedback on their activity without it bogging them down. You can tweak this structure slightly, and it will be good enough. It just comes down to getting your reps to follow the process, which is all about daily reinforcement until it’s habitual.

The Hidden Cost of Bad Data

Here's the brutal math of bad data:

Average BDR makes 100 dials per day

With 3% decision maker contact rate = 3 conversations

With 4% meeting book rate = 0.12 meetings per day

Compare that to good data:

Same 100 dials

13% decision maker contact rate = 13 conversations

16% meeting book rate = 2.08 meetings per day (influenced by more than just data)

That's the difference between a BDR motion that bleeds money and one that prints it. But here's what most leaders miss - this isn't just about efficiency. Bad data creates a vicious cycle:

Reps get discouraged from constant wrong numbers

They start cutting corners in their process

Quality of execution drops

Results get worse

Turnover increases

Keep reading with a 7-day free trial

Subscribe to The Revenue Leadership Podcast to keep reading this post and get 7 days of free access to the full post archives.